Page 88 - Nanyang Technological University

P. 88

NOTES TO FINANCIAL STATEMENTS

(cont’d)

31 March 2016

30 FINANCIAL INSTRUMENTS, FINANCIAL RISKS AND CAPITAL RISKS MANAGEMENT (cont’d)

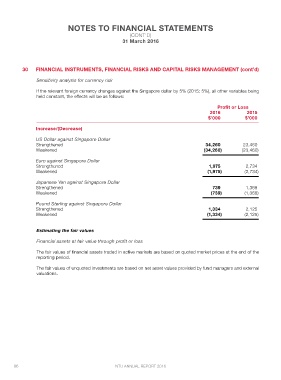

Sensitivity analysis for currency risk

If the relevant foreign currency changes against the Singapore dollar by 5% (2015: 5%), all other variables being

held constant, the effects will be as follows:

Profit or Loss

2016 2015

$’000 $’000

Increase/(Decrease)

US Dollar against Singapore Dollar 34,260 23,460

Strengthened (34,260) (23,460)

Weakened

Euro against Singapore Dollar 1,975 2,734

Strengthened

Weakened (1,975) (2,734)

Japanese Yen against Singapore Dollar 739 1,368

Strengthened

Weakened (739) (1,368)

Pound Sterling against Singapore Dollar 1,334 2,125

Strengthened

Weakened (1,334) (2,125)

Estimating the fair values

Financial assets at fair value through profit or loss

The fair values of financial assets traded in active markets are based on quoted market prices at the end of the

reporting period.

The fair values of unquoted investments are based on net asset values provided by fund managers and external

valuations.

86 NTU ANNUAL REPORT 2016