Page 92 - Nanyang Technological University

P. 92

NOTES TO FINANCIAL STATEMENTS

(cont’d)

31 March 2016

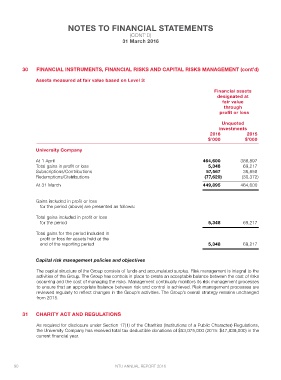

30 FINANCIAL INSTRUMENTS, FINANCIAL RISKS AND CAPITAL RISKS MANAGEMENT (cont’d)

Assets measured at fair value based on Level 3:

Financial assets

designated at

fair value

through

profit or loss

Unquoted

investments

2016 2015

University Company $’000 $’000

At 1 April 464,600 386,897

Total gains in profit or loss

Subscriptions/Contributions 5,348 69,217

Redemptions/Distributions

57,567 38,858

At 31 March

(77,620) (30,372)

449,895 464,600

Gains included in profit or loss 5,348 69,217

for the period (above) are presented as follows: 5,348 69,217

Total gains included in profit or loss

for the period

Total gains for the period included in

profit or loss for assets held at the

end of the reporting period

Capital risk management policies and objectives

The capital structure of the Group consists of funds and accumulated surplus. Risk management is integral to the

activities of the Group. The Group has controls in place to create an acceptable balance between the cost of risks

occurring and the cost of managing the risks. Management continually monitors its risk management processes

to ensure that an appropriate balance between risk and control is achieved. Risk management processes are

reviewed regularly to reflect changes in the Group’s activities. The Group’s overall strategy remains unchanged

from 2015.

31 CHARITY ACT AND REGULATIONS

As required for disclosure under Section 17(1) of the Charities (Institutions of a Public Character) Regulations,

the University Company has received total tax deductible donations of $53,075,000 (2015: $47,839,000) in the

current financial year.

90 NTU ANNUAL REPORT 2016