Page 85 - Nanyang Technological University

P. 85

NOTES TO FINANCIAL STATEMENTS

(cont’d)

31 March 2016

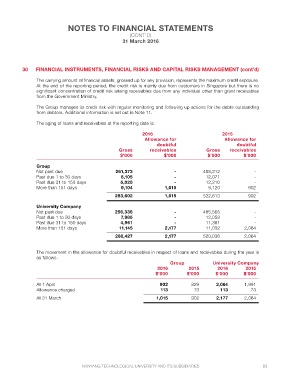

30 FINANCIAL INSTRUMENTS, FINANCIAL RISKS AND CAPITAL RISKS MANAGEMENT (cont’d)

The carrying amount of financial assets, grossed up for any provision, represents the maximum credit exposure.

At the end of the reporting period, the credit risk is mainly due from customers in Singapore but there is no

significant concentration of credit risk arising receivables due from any individual other than grant receivables

from the Government Ministry.

The Group manages its credit risk with regular monitoring and following up actions for the debts outstanding

from debtors. Additional information is set out in Note 11.

The aging of loans and receivables at the reporting date is:

2016 2015

Allowance for Allowance for

doubtful doubtful

Gross receivables Gross receivables

$’000 $’000 $’000 $’000

Group

Not past due 261,373 - 489,212 -

Past due 1 to 30 days 8,105 - 12,071 -

Past due 31 to 150 days 5,020 - 12,210 -

More than 151 days 9,104 1,015 9,120 902

283,602 1,015 522,613 902

University Company 256,336 - 485,565 -

Not past due 12,058 -

Past due 1 to 30 days 7,985 - 11,381 -

Past due 31 to 150 days 11,032 2,064

More than 151 days 4,961 -

520,036 2,064

11,145 2,177

280,427 2,177

The movement in the allowance for doubtful receivables in respect of loans and receivables during the year is

as follows:

Group University Company

2016 2015 2016 2015

$’000 $’000 $’000 $’000

At 1 April 902 829 2,064 1,991

Allowance charged 113 73

113 73

At 31 March 1,015 902

2,177 2,064

NANYANG TECHNOLOGICAL UNIVERSITY AND ITS SUBSIDIARIES 83