Page 81 - Nanyang Technological University

P. 81

NOTES TO FINANCIAL STATEMENTS

(cont’d)

31 March 2016

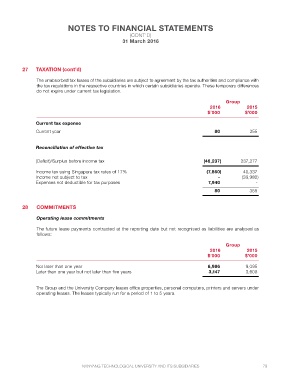

27 TAXATION (cont’d)

The unabsorbed tax losses of the subsidiaries are subject to agreement by the tax authorities and compliance with

the tax regulations in the respective countries in which certain subsidiaries operate. These temporary differences

do not expire under current tax legislation.

Group

2016 2015

Current tax expense $’000 $’000

Current year 80 355

Reconciliation of effective tax (46,237) 237,277

(Deficit)/Surplus before income tax (7,860) 40,337

Income tax using Singapore tax rates of 17% - (39,982)

Income not subject to tax

Expenses not deductible for tax purposes 7,940 -

80 355

28 COMMITMENTS

Operating lease commitments

The future lease payments contracted at the reporting date but not recognised as liabilities are analysed as

follows:

Group

2016 2015

$’000 $’000

Not later than one year 6,986 9,095

Later than one year but not later than five years

3,147 3,608

The Group and the University Company leases office properties, personal computers, printers and servers under

operating leases. The leases typically run for a period of 1 to 5 years.

NANYANG TECHNOLOGICAL UNIVERSITY AND ITS SUBSIDIARIES 79