Page 80 - Nanyang Technological University

P. 80

NOTES TO FINANCIAL STATEMENTS

(cont’d)

31 March 2016

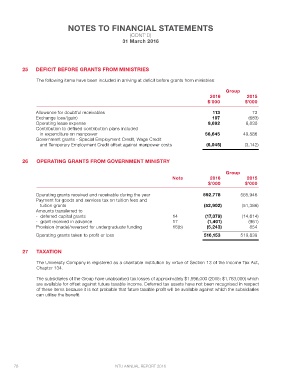

25 DEFICIT BEFORE GRANTS FROM MINISTRIES

The following items have been included in arriving at deficit before grants from ministries:

Group

2016 2015

$’000 $’000

Allowance for doubtful receivables 113 73

Exchange loss/(gain) 197 (683)

Operating lease expense 9,692 8,830

Contribution to defined contribution plans included

in expenditure on manpower 56,645 49,586

Government grants - Special Employment Credit, Wage Credit

and Temporary Employment Credit offset against manpower costs (6,045) (3,142)

26 OPERATING GRANTS FROM GOVERNMENT MINISTRY

Group

Note

2016 2015

$’000 $’000

Operating grants received and receivable during the year 592,778 585,946

Payment for goods and services tax on tuition fees and

tuition grants (52,902) (51,386)

Amounts transferred to

- deferred capital grants 14 (17,079) (14,614)

- grant received in advance 17 (1,401) (961)

Provision (made)/reversed for undergraduate funding 16(b) (5,243) 854

Operating grants taken to profit or loss 516,153 519,839

27 TAXATION

The University Company is registered as a charitable institution by virtue of Section 13 of the Income Tax Act,

Chapter 134.

The subsidiaries of the Group have unabsorbed tax losses of approximately $1,596,000 (2015: $1,763,000) which

are available for offset against future taxable income. Deferred tax assets have not been recognised in respect

of these items because it is not probable that future taxable profit will be available against which the subsidiaries

can utilise the benefit.

78 NTU ANNUAL REPORT 2016