Page 71 - Nanyang Technological University

P. 71

NOTES TO FINANCIAL STATEMENTS

(cont’d)

31 March 2016

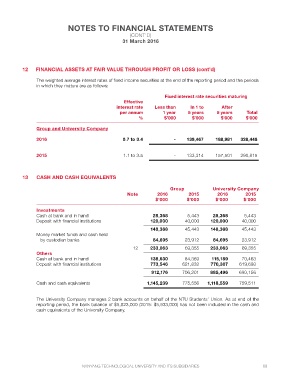

12 FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS (cont’d)

The weighted average interest rates of fixed income securities at the end of the reporting period and the periods

in which they mature are as follows:

Fixed interest rate securities maturing

Effective

interest rate Less than In 1 to After

per annum 1 year 5 years 5 years Total

% $’000 $’000 $’000 $’000

Group and University Company

2016 0.7 to 3.4 - 139,467 188,981 328,448

2015 1.1 to 3.5 - 133,314 157,501 290,815

13 CASH AND CASH EQUIVALENTS

Group University Company

Note 2016 2015 2016 2015

$’000 $’000 $’000 $’000

Investments 28,368 5,443 28,368 5,443

Cash at bank and in hand

Deposit with financial institutions 120,000 40,000 120,000 40,000

148,368 45,443 148,368 45,443

Money market funds and cash held

by custodian banks 84,695 23,912 84,695 23,912

12 233,063 69,355 233,063 69,355

Others

Cash at bank and in hand 138,630 84,369 115,189 70,463

Deposit with financial institutions 773,546 621,832 770,307 619,693

912,176 706,201 885,496 690,156

Cash and cash equivalents 1,145,239 775,556 1,118,559 759,511

The University Company manages 2 bank accounts on behalf of the NTU Students’ Union. As at end of the

reporting period, the bank balance of $5,823,000 (2015: $5,933,000) has not been included in the cash and

cash equivalents of the University Company.

NANYANG TECHNOLOGICAL UNIVERSITY AND ITS SUBSIDIARIES 69