Page 69 - Nanyang Technological University

P. 69

NOTES TO FINANCIAL STATEMENTS

(cont’d)

31 March 2016

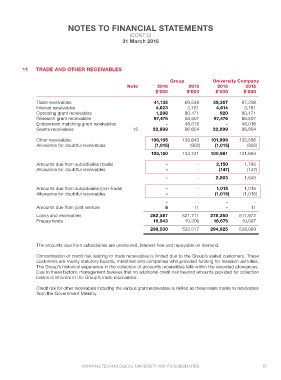

11 TRADE AND OTHER RECEIVABLES

Group University Company

Note 2016 2015 2016 2015

$’000 $’000 $’000 $’000

Trade receivables 41,135 69,548 39,357 67,208

Interest receivables 4,623 3,761 4,614 3,761

Operating grant receivables 1,298 80,471 920 80,471

Research grant receivables 97,476 88,507 97,476 88,507

Endowment matching grant receivables - 48,018 - 48,018

Grants receivables 15 32,899 96,654 32,899 96,654

Other receivables 106,165 135,643 101,996 132,596

Allowance for doubtful receivables (1,015) (902) (1,015) (902)

105,150 134,741 100,981 131,694

Amounts due from subsidiaries (trade) - - 2,150 1,795

Allowance for doubtful receivables - - (147) (147)

- - 2,003 1,648

Amounts due from subsidiaries (non-trade) - - 1,015 1,015

Allowance for doubtful receivables - - (1,015) (1,015)

- - - -

6 11 - 11

Amounts due from joint venture

Loans and receivables 282,587 521,711 278,250 517,972

Prepayments 16,943 10,306 16,675 10,097

299,530 532,017 294,925 528,069

The amounts due from subsidiaries are unsecured, interest-free and repayable on demand.

Concentration of credit risk relating to trade receivables is limited due to the Group’s varied customers. These

customers are mainly statutory boards, ministries and companies who provided funding for research activities.

The Group’s historical experience in the collection of accounts receivables falls within the recorded allowances.

Due to these factors, management believes that no additional credit risk beyond amounts provided for collection

losses is inherent in the Group’s trade receivables.

Credit risk for other receivables including the various grant receivables is limited as these relate mainly to receivables

from the Government Ministry.

NANYANG TECHNOLOGICAL UNIVERSITY AND ITS SUBSIDIARIES 67