Page 68 - Nanyang Technological University

P. 68

NOTES TO FINANCIAL STATEMENTS

(cont’d)

31 March 2016

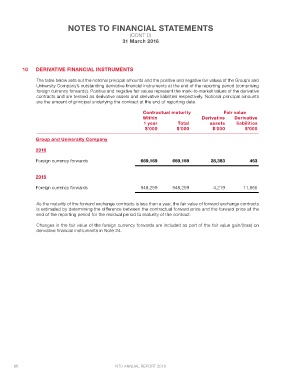

10 DERIVATIVE FINANCIAL INSTRUMENTS

The table below sets out the notional principal amounts and the positive and negative fair values of the Group’s and

University Company’s outstanding derivative financial instruments at the end of the reporting period (comprising

foreign currency forwards). Positive and negative fair values represent the mark-to-market values of the derivative

contracts and are termed as derivative assets and derivative liabilities respectively. Notional principal amounts

are the amount of principal underlying the contract at the end of reporting date.

Contractual maturity Fair value

Within Derivative Derivative

1 year Total assets liabilities

$’000 $’000 $’000 $’000

Group and University Company

2016

Foreign currency forwards 669,169 669,169 28,383 453

2015 948,259 948,259 4,219 11,665

Foreign currency forwards

As the maturity of the forward exchange contracts is less than a year, the fair value of forward exchange contracts

is estimated by determining the difference between the contractual forward price and the forward price at the

end of the reporting period for the residual period to maturity of the contract.

Changes in the fair value of the foreign currency forwards are included as part of the fair value gain/(loss) on

derivative financial instruments in Note 24.

66 NTU ANNUAL REPORT 2016