Page 70 - Nanyang Technological University

P. 70

NOTES TO FINANCIAL STATEMENTS

(cont’d)

31 March 2016

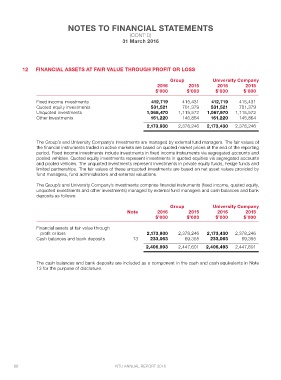

12 FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

Group University Company

2016 2015 2016 2015

$’000 $’000 $’000 $’000

Fixed income investments 412,719 415,431 412,719 415,431

Quoted equity investments 531,521 701,379 531,521 701,379

Unquoted investments 1,068,470 1,115,572 1,067,970 1,115,572

Other investments 161,220 145,864 161,220 145,864

2,173,930 2,378,246 2,173,430 2,378,246

The Group’s and University Company’s investments are managed by external fund managers. The fair values of

the financial instruments traded in active markets are based on quoted market prices at the end of the reporting

period. Fixed income investments include investments in fixed income instruments via segregated accounts and

pooled vehicles. Quoted equity investments represent investments in quoted equities via segregated accounts

and pooled vehicles. The unquoted investments represent investments in private equity funds, hedge funds and

limited partnerships. The fair values of these unquoted investments are based on net asset values provided by

fund managers, fund administrators and external valuations.

The Group’s and University Company’s investments comprise financial instruments (fixed income, quoted equity,

unquoted investments and other investments) managed by external fund managers and cash balances and bank

deposits as follows:

Group University Company

Note 2016 2015 2016 2015

$’000 $’000 $’000 $’000

Financial assets at fair value through

profit or loss 2,173,930 2,378,246 2,173,430 2,378,246

Cash balances and bank deposits 13 233,063 69,355 233,063 69,355

2,406,993 2,447,601 2,406,493 2,447,601

The cash balances and bank deposits are included as a component in the cash and cash equivalents in Note

13 for the purpose of disclosure.

68 NTU ANNUAL REPORT 2016