Page 67 - Nanyang Technological University

P. 67

NOTES TO FINANCIAL STATEMENTS

(cont’d)

31 March 2016

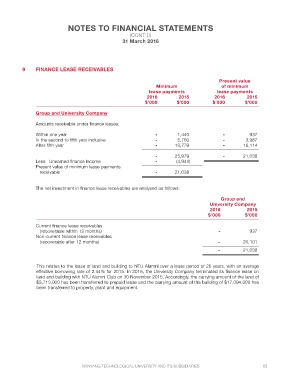

9 FINANCE LEASE RECEIVABLES

Present value

Minimum of minimum

lease payments lease payments

2016 2015 2016 2015

$’000 $’000 $’000 $’000

Group and University Company

Amounts receivable under finance leases:

Within one year - 1,440 - 937

In the second to fifth year inclusive - 5,760 - 3,987

After fifth year - 18,779 - 16,114

- 25,979 - 21,038

Less: Unearned finance income - (4,941)

Present value of minimum lease payments

receivable - 21,038

The net investment in finance lease receivables are analysed as follows: Group and

University Company

2016 2015

$’000 $’000

Current finance lease receivables

(recoverable within 12 months) - 937

Non-current finance lease receivables

(recoverable after 12 months) - 20,101

- 21,038

This relates to the lease of land and building to NTU Alumni over a lease period of 26 years, with an average

effective borrowing rate of 2.44% for 2015. In 2016, the University Company terminated its finance lease on

land and building with NTU Alumni Club on 30 November 2015. Accordingly, the carrying amount of the land of

$3,713,000 has been transferred to prepaid lease and the carrying amount of the building of $17,094,000 has

been transferred to property, plant and equipment.

NANYANG TECHNOLOGICAL UNIVERSITY AND ITS SUBSIDIARIES 65