|

Financing climate adaptation in the Asia-Pacific: Avoiding flawed aid paradigms

The Asia-Pacific is highly vulnerable to the intertwined physical and social impacts of climate change, and effective adaptation measures are a regional imperative. Such climate adaptation plans are predicated in part on external assistance that is actuated through financial mechanisms. What is less clear is how these mechanisms actually operate, what problems they foment and what pitfalls need to avoided in future policies. In the course of addressing these points, this NTS Insight warns of a potential ‘climate finance curse’ akin to the ‘aid curse’ described in broader development literature, and identifies pathways for avoiding such risks.

By J. Jackson Ewing and Gianna Gayle Amul

| International climate change talks are seeing a growing chorus of support for financial flows from developed to developing states in the name of adaptation. It is thus timely to explore pathways for the effective and efficient utilisation of adaptation funds.

Credit: UNclimatechange / flickr. |

|

Contents:

Recommended citation: J. Jackson Ewing and Gianna Gayle Amul, ‘Financing climate adaptation in the Asia-Pacific: Avoiding flawed aid paradigms’, NTS Insight, no. IN13-03 (Singapore: RSIS Centre for Non-Traditional Security (NTS) Studies, 2013).

| |

Introduction

This NTS Insight explores impediments to effective climate-adaptation financing in the Asia-Pacific. Countries, communities and various actors in the region face acute climate change challenges, and seek resources as part of efforts to adapt to climate vulnerabilities. This is consistent with the broader objectives of developing countries within the UN Framework Convention on Climate Change (UNFCCC) negotiations, which focus on garnering support from wealthier countries for adaptation and for transitioning to lower-emissions futures. Such externally funded adaptation finance is both needed and justified in the Asia-Pacific, as the region suffers the effects of emissions both past and present emanating from afar.

Needs and justifications notwithstanding, international climate finance is no panacea. To access climate funds, vulnerable states and sub-state actors may be put in a position to overemphasise vulnerability and focus unduly on climate change as the cause of a wide range of problems. Such actors may also be ill-prepared to deal with the adaptation resources that do arrive. These problems are compounded by the fact that accessing international climate finance requires skills and capacities that vary greatly among different players and involve convoluted institutional architectures.

This NTS Insight expands on these dynamics to warn of a potential ‘climate finance curse’ akin to the ‘aid curse’ described in broader development literature. To this end, it briefly reviews the climate vulnerabilities confronting the Asia-Pacific, unpacks international adaptation funding architectures and explores the risks of morally hazardous approaches to climate finance. It concludes with principles and solutions that could help enhance the effectiveness of regional adaptation projects.

^ To the top

Climate vulnerabilities in the Asia-Pacific: An overview

Physical vulnerabilities and climate extremes

The Asia-Pacific region contends with a litany of climate change challenges. Hazard, risk and vulnerability assessments highlight the region’s fraught climate circumstances, with Bangladesh, the Philippines, Thailand, Vietnam, Myanmar, Indonesia and India receiving particular attention.1 The geographic and climatic character of the region – including various susceptibilities to tropical cyclones, floods, landslides, sea level rise and droughts – drives these vulnerabilities and contributes to alarming disaster calculations. Specifically, 45 per cent of the world’s natural disasters in recent decades occurred in the Asia-Pacific.2 In 2012 alone, 93 disasters were recorded in the region, affecting 75 million people and killing some 3,200.3 For the period 1970–2011, 74 per cent of human fatalities from natural disasters were from the Asia-Pacific.4 Economic losses from natural disasters in the region for 2000–2011 amounted to USD719.46 billion dollars.5

Cities that extend into hazard-prone coastal areas are at high risk of acute climate-related human and economic losses. Increasing recognition of such problems has given adaptation greater prominence at international climate talks.

Credit: International Rivers / flickr. Slower-onset climatic changes also afflict the Asia-Pacific. Sea level rise is impacting coastal ecosystems, aquaculture industries, coastal infrastructure and may lead to significant displacements of people.6 It also threatens the availability of freshwater for humans and coastal ecosystems.7 Such phenomena contribute to increasing vulnerability in South, Southeast and East Asia (especially in Asia’s megadeltas) and the small islands of the Pacific.8 Beyond sea level rise, the region faces changing precipitation patterns that impact agriculture and intermingle both drought and flooding; shifting ocean temperatures that stress aquatic animals and habitats; and freshwater strains resulting from changes in the composition of glaciers. The resulting regional impacts of climate change, whether through abrupt shocks or slower-onset changes, are substantial for developing economies, their critical infrastructures and the peoples that depend upon them. Moreover, the Asia-Pacific’s socioeconomic characteristics amplify these vulnerabilities in various parts of the region.

Social vulnerabilities and adaptive capacities

The Asia-Pacific is host to an array of socioeconomic conditions, and a variety of deficient natural resource management strategies born largely from emphases on short-term development.9 In rural areas, small-scale farming, fishing, hunting and other sources of sustenance and income are increasingly threatened by environmental degradation. Populations dependent on these sectors often have few adaptation options, which can in turn lead to their encroachment into risk-prone areas and unproductive, ‘ecologically fragile lands’.10 In urban settings, as populations grow, infrastructure and people extend further into low-lying coastlines, floodplains, riverbanks and the like.11 Heatwaves and urban heat islands also cause major health problems and erode quality of life. These conditions are exacerbated by growth of over-crowded, often informal, and sub-standard settlements that find marginalised segments of society living with everyday hardships and on the precipice of disaster from extreme events.12 Climate change intensifies these and other problems.

Such climate vulnerabilities – whether physical or social, urban or rural – have moved adaptation up the UNFCCC agenda. For reasons spanning altruism and societal solidarity to climate responsibility and culpability, there has been a growing chorus of support for financial flows moving from developed to developing states in the name of adaptation. While such support is understandable and in many ways apt, the following section questions the effectiveness of current adaptation financing, and cautions against falling into familiar patterns of ineffectual resource transfers from developed to developing states.

^ To the top

Finance and resource transfer as the UNFCCC response

Complex and technocratic financial mechanisms

Accessing climate finance is far from straightforward, with structures containing a myriad of overlapping global, multilateral, bilateral and national funds. Resulting climate finance mechanisms, moreover, can be public, private or market-based. Countries wishing to access resources need first to understand the range of funds, what they are for and how to apply for them – which is often a complicated process.13 Funds also typically have different criteria, characteristics and objectives, meaning that courting one fund after another often requires essentially beginning processes anew.14

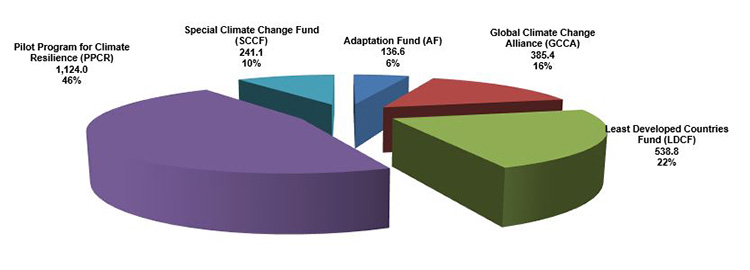

The Adaptation Fund (AF) attempts to create a single mechanism to avoid these obstacles. The AF is operated through National Implementing Entities and acts as a direct-access15 funding facility. It is financed through a 2 per cent levy on the sale of certified emission reduction (CER) credits from the Clean Development Mechanism (CDM) and through contributions from governments, the private sector and individuals. The AF’s inclusive and encompassing nature has proven to be a weakness however, as it has failed to secure and operationalise significant levels of funding during its tenure. As a result, the AF has only accounted for 6 per cent of pledged funds in the Asia-Pacific since 2003 (Figure 1).

Other funds dedicated to adaptation activities in the Asia-Pacific are the Global Climate Change Alliance (GCCA), the Least Developed Countries Fund (LDCF), the Special Climate Change Fund (SCCF) and the Pilot Program for Climate Resilience (PPCR), as seen in Figure 1. The PPCR accounts for more than half of the pledged adaptation finance for the region (USD1.124 billion). The Asia-Pacific has so far received 25 per cent of the disbursed global funding for adaptation (about USD92.3 million since 2003).16

Figure 1: Major sources of adaptation finance in the Asia-Pacific region (in USD million), 2003–2012.

Source: Dataset from ‘Regional trends: Asia and the Pacific’, Climate Funds Update, accessed 26 February 2013, http://www.climatefundsupdate.org/regions/asia-pacific.

A closer look into the two largest source of adaptation finance demonstrates how these complex and overlapping funds impact the region’s resilience objectives. The PPCR operates through multilateral banks to encourage private sector involvement, and it tries to support resilience activities that are also viable as investments. Of particular concern to the PPCR are: (1) ‘higher investment costs’ compared to the usual development projects; (2) ‘lack of access to capital’ due to complex requirements, poor creditworthiness and uncertainty about climate variability and vulnerability; (3) misperceptions about the risks in integrating climate-related factors in development programmes; (4) ‘lack of technical skills and information’; and (5) ‘constrained ability to pay’ for climate-resilient development.17 In other words, the PPCR seeks to mitigate risks to development investments through advancing adaptation.

Implementation of these schemes then occurs through individual countries’ own Strategic Program for Climate Resilience as a framework. Currently, the PPCR has country programmes in Bangladesh, Cambodia, Nepal and Papua New Guinea. However, a number of issues have been raised that highlight the knotty nature of climate finance architectures. Namely, critics assert that the PPCR risks overlapping with and possibly undermining the roles and functions of the AF, LDCF and SCCF, creating unhelpful competition for donor funding.18

The LDCF is the second largest source of adaptation finance in the region. It is operated by the Global Environment Facility and is dedicated to financing National Adaptation Programs of Action from formulation to implementation. The LDCF focuses on vulnerable sectors and resources that are vital for development, including water, health, agriculture and food security, disaster risk management and prevention, infrastructure and fragile ecosystems.19 Just as the PPCR is implemented within a national framework for climate resilience, the LDCF also offers national ownership of adaptation activities that are formulated according to the country’s perceived needs (see Table 1 for comparisons of recipient involvement in different funds).

Even so, the LDCF’s attempt to simplify and streamline its own procedures has been a struggle. LDCF programmes have neglected to tap public sector experts, been overly reliant on independent consultants and have suffered from the lack of intra-governmental mechanisms to engage the respective National Adaptation Programs of Action.20 Moreover, most of the major funds for adaptation including the PPCR and LDCF are also criticised for the political and scientific ambiguity of vulnerability as a criterion for allocating funding.21 The following section explores that criterion in greater detail.

|

Table 1: Major financial mechanisms for adaptation in the Asia-Pacific.

|

Mechanism |

Major source of funds |

Included as Official Development Assistance |

Delivery |

Access |

Recipient involvement |

| Adaptation Fund (AF) |

From 2% of the sales of certified emission reductions (CERs) and voluntary donor contributions |

No |

Grants |

Direct access.

There is an accreditation process for national, regional or multilateral implementing entities |

Through implementing entities |

| Global Climate Change Alliance (GCCA) |

European Commission budget, European Development Fund, voluntary contributions and Fast-Start Finance (FSF) contributions |

Yes |

Grants |

There is as yet no access mechanism. |

Dialogue-based planning and country-assistance strategies |

| Least Developed Countries Fund (LDCF) |

Voluntary donor contributions |

Yes |

Grants |

National Adaptation Programs of Action (NAPAs) are submitted to the UN Framework Convention on Climate Change (UNFCCC) before project implementation |

Country-led |

| Pilot Program for Climate Resilience (PPCR) |

Voluntary donor contributions |

Yes |

Grants and concessional loans |

Through multilateral development banks |

Country-led |

| Special Climate Change Fund (SCCF) |

Voluntary donor contributions |

Yes |

Grants |

Projects are coursed through the implementing agencies of the Global Environment Facility (GEF) |

Nationally owned |

Source: ‘Climate fund profiles’ on the Adaptation Fund, Global Climate Change Alliance, Least Developed Countries Fund, Pilot Program for Climate Resilience, Special Climate Change Fund, in Climate Funds Update, 2012, accessed 4 March 2013, http://www.climatefundsupdate.org/listing

|

^ To the top

Moral hazards of adaptation finance

Culpability and responsibility to assist

Beyond the convoluted structures and ambiguities concerning climate finance, there are broader questions about the rights and responsibilities of both providers and recipients of adaptation resources. As recognition of the need for climate adaptation finance has grown, the processes and pathways for determining who gets what from whom have become increasingly thorny. The continuing discourse on the culpability of Annex 1 (largely developed) countries and their responsibility to support climate change responses in non-Annex 1 countries is at the centre of such processes.22

One dynamic that has limited adaptation support is the historical prioritisation of climate mitigation. From 2004 to 2012, 77 per cent of climate funds in the Asia-Pacific were allocated to mitigation compared with 16 per cent for adaptation.23 Among the many differences separating mitigation and adaptation is that, for the latter, positive externalities are perceived to largely benefit only targeted countries. Costs for adaptation are expected to be shared globally (with the majority of the ‘burden’ on developed Annex 1 countries) but the benefits from adaptation to climate change are felt almost exclusively by recipient non-Annex 1 states. For example, improved agricultural practices and climate-resilient housing – familiar adaptation activities – are mostly beneficial to communities engaged in such projects and do not directly impact on donor countries’ own mitigation or adaptation efforts. Adaptation has therefore not been considered a global public good in the same vein as the management of human impacts on global atmospheric conditions.24

Beyond global public goods however, many arguing for the urgency of funding adaptation link it to the targeted protection of human welfare and redressment of past and ongoing wrongs. These sentiments, explored in greater detail in the following section, are reinforced by calls from developing states for compensation for ‘loss and damages’ brought about by the impacts of climate change.25 The targets of these calls are Annex 1 countries said to have a historical climate debt resulting from greenhouse gas emissions over the course of their own development. The ‘polluter pays’ principle thus underpins UNFCCC negotiations on adaptation.26 However, with Annex 1 countries struggling to meet their pledges under current UNFCCC agreements, the prospects of getting timely and predictable funds for adaptation through this process may rest on shaky ground. There are also pervasive questions about culpability that grow alongside the economic emergence, and attendant growing emissions levels, of large developing states.

This final point above is particularly germane to the Asia-Pacific, where high-emitting developing states such as China, India and Indonesia present increasing challenges for climate finance structures. These states straddle the boundary between being developing countries eligible to secure climate finance and being major emitters of greenhouse gases with the responsibility to allocate resources for climate finance. This clouds the discourse at international climate talks, where the question of who bears the responsibility and the costs of climate change has traditionally been dealt with through the Annex 1/non-Annex 1 divide and the principle of ‘common but differentiated responsibilities’.27 It has become increasingly difficult to discern which countries are well-placed and duty-bound to contribute to climate finance and which are most justified in receiving it. The concern for distributive justice in climate policy thus highlights not only ‘burden sharing’ but also continues to challenge the international community to grapple with questions relating to ‘burden-takers’ and ‘recipients of benefits’.28

Inflation of vulnerability levels

Vulnerability arguments for adaptation funding rest on the principle that impacted countries and communities will face increasingly untenable futures without external support. There is an understanding that to be effective, such support should be designed to fit the particular circumstances of recipients and targeted towards the areas of greatest need. Recommendations for long-term, sustainable and participatory approaches to building resilience and adaptive capacities are therefore common in a region with risks of the magnitude faced by the Asia-Pacific. However, with access to adaptation finance resting on evidence of climate vulnerability, there is a risk that countries and communities will ostensibly compete to put forward the most confronting vulnerability assessments. Placing countries and communities in a position to argue that their levels of vulnerability are higher than those faced elsewhere – hence increasing their attractiveness as funding destinations – is rife with moral hazard.

Flooding, saltwater intrusion, desertification, heatwaves, droughts, the increasing frequency of natural disasters and other plights in the Asia-Pacific can all have discernable connections to climate change. Climate change is not, however, typically the only relevant driver and in some cases not even the most important. For instance, saltwater intrusion and flooding can be driven by extractions from watertables and land subsidence, desertification can be amplified by deforestation, and heatwaves can be exacerbated by a lack of green spaces. The results of these physical changes likewise depend very much on the social contexts in which they play out.29 Climate finance opportunities can encourage countries to place many such issues squarely under the climate change umbrella for the sake of accessing adaptation support. Such claims can be both logically dubious and lead to climate-centric solutions that do not address numerous root problems.

Loss, damages and compensation

Justifications for the need for adaptation finance do not stop with vulnerability, but also focus on the status of developing states, communities and individuals as victims of climate change. These arguments call for ‘compensation’, which has been steadily resisted by Annex 1 countries and could represent a red line. This victimhood discourse recently found traction at the 18th session of the Conference of the Parties to the UNFCCC (COP18) in Doha, when the UNFCCC established an international mechanism to ‘address loss and damage associated with the impacts of climate change in developing countries that are particularly vulnerable to the adverse effects of climate change’.30 This clause stems from a common argument touted by civil society and a large sample of developing states that developed countries must pay their ‘climate debt’.31 Potential future payments will include support to developing countries to address mitigation and adaptation, and recompense for ‘loss and damages’ relating to climate change.32

These arguments, which are not set to dissipate, are justifiable on the grounds of past and continuing emissions by developed states and recognise the very real need in many developing countries for adaptation assistance. However, they do not address the previously discussed problem of non-climatic issues, such as poor infrastructure, disaster planning and response, political inefficacies and so forth, finding their way into a country’s climate impact claims. As such, a ‘global compensation fund’ (for climatic shocks to be financed by all countries party to the UNFCCC to cover losses in developing countries) may encounter difficulty in determining what to compensate for.33

Compensation also mirrors challenges relating to climate insurance at the individual level. Insurance for climate shocks can serve as a disincentive if it is the only means to reduce risk and as such mimics the ‘feeling of security while actually leaving people overly exposed to impacts’.34 Climate insurance/compensation that is not undertaken in tandem with effective long-term adaptation activities, such as strengthening critical infrastructure and essential services, will be little more than a stopgap approach. Moreover, insurance/compensation cannot cover intangible and unquantifiable long-term loss and damage such as socio-psychological trauma suffered by victims of humanitarian emergencies, or loss of heritage and identity for people who need to move due to eventual loss of habitable environments. This renders global compensation funding a dubious goal if pursued in lieu of pre-emptive and impactful climate adaptation strategies.

These issues notwithstanding, financing adaptation and possibly compensation can lead the developing world to come to a more positive ‘perception of fairness’ regarding climate response strategies.35 By prioritising and funding adaptation measures, source (Annex 1) countries can help bridge the developing-developed country divide that has been crippling to UNFCCC negotiations.36 Such measures have the potential to pay dividends in other climate negotiation tracks, most notably in the ongoing efforts to set emissions targets for large emerging economies. There is still the issue, however, of how adaptation resources will be utilised.

Corruption

In spite of safeguards, resource flows from climate finance will fuel some level of corruption. The World Bank’s global estimate for the cost of adaptation ranges from USD70 billion to USD100 billion per year between 2010 and 2050 which, although unlikely to be realised, means that substantial international financial flows will be a key element of adaptation objectives.37 There is little reason to expect that climate finance will be immune to the same dynamics that drive corruption in other sectors, and caution will need to be exercised regarding the effects of influxes of cash. Transparency International has warned that 20 of the countries extremely vulnerable to climate change are also among the most corrupt in the world.38 In the Asia-Pacific, 18 countries scored 40 and below in the 2012 Corruption Perceptions Index (0 means that a country is perceived as highly corrupt and 100 means it is perceived as very scrupulous).39 They include Timor-Leste, Nepal, Bangladesh, Papua New Guinea, Cambodia and Lao PDR, all of which also rank high in vulnerability.40

The transparency, accountability and integrity (and lack thereof) of implementing institutions, including the World Bank,41 contribute to the vulnerability of climate finance itself to corruption. If left unchecked, this will delegitimise global climate policy at state and local levels.42 The interest of policymakers and private sector actors to utilise financial services for the implementation of climate policies has not led to any definitive regulation on how capital from climate finance can be managed and allocated.43 Ensuring accountable policy actuation is essential, as even the mere perception of corruption from lack of fairness and institutional trust can be detrimental to climate finance goals.44

^ To the top

Opportunities for effective adaptation finance

Learning from the ‘aid curse’

Foreign aid experiences offer precedents for avoiding many of the pitfalls that plague adaptation efforts. Like aid, climate finance is generally ‘a voluntary transfer of public resources, from a government to another independent government, to an NGO, or to an international organization with at least a 25 per cent grant element, one goal of which is to better the human condition in the country receiving the aid’.45 The risks of a ‘climate finance curse’46 – akin to the ‘aid curse’47 that has been observed in wider development initiatives – should be acknowledged so that adaptation finance neither undermines effective development nor encourages poor governance. Adaptation finance is particularly susceptible to these shortcomings as its mechanisms are often included as development aid and delivered mostly as grants (see Table 1).

Foreign aid has been found through a large number of studies to not only at times contribute to rent-seeking tendencies but also weaken democratic institutions in recipient countries.48 It has also been found to increase the predatory power of governments49 and create vicious cycles of dependency. The aid curse is further reinforced when aid becomes fungible, through funds being opened up for purposes different from donors’ intentions, and when aid becomes a flexible revenue or income source that recipient governments are free to spend in any manner they choose.50 The fungibility of climate finance has not yet gained scholarly attention since most climate funds are channelled through national adaptation and resilience strategies, specific projects and time-bound programmes. Whether the issue is weak governance or fungibility, substandard policies result. Transparency has always been recognised as imperative to efficient and targeted use of development aid, and it is likewise vital for climate finance.

A critical lesson from wider aid experiences is to tie resource flows to the institutions, policies and particular needs of recipient governments.51 All those affected by adaptation activities will then have a stake in owning the process and eventually the outcomes of local climate governance. This would require efforts to ensure that ‘aid projects are consistent with recipient priorities’ and help ‘build the budget and project management capacity of recipient country governments and non-governmental organisations that administer the assistance’.52 Supporting actors such as local grassroots, regional or international non-governmental organisations are crucial for creating the bridge between communities and the different financial mechanisms that can help them to build resilience. At higher levels, climate adaptation efforts are charged with finding a balance between retaining key overarching principles and the need for flexible implementation practices that recognise local circumstances. Consultation, multi-stakeholder engagement and capacity building during the implementation of adaptation activities are thus paramount.

Even with such consultations, implementation remains challenging. Experiences with broader development aid show that it is often difficult for donor and recipient actors to effectively and efficiently utilise resources.53 This can result from overly top-down or misguided strategies by donors, and/or project formulation and actuation deficits by recipients. Bureaucratic inefficiencies at various levels can also impede the effectiveness of adaptation strategies.54 Traditional bureaucratic arrangements can constrain the integration of adaptation into the institutional and governance frameworks.55 Institutional difficulties that can compromise local adaptation objectives also reflect the complex bureaucracy at the international level of climate policy. International channels for adaptation project approval can be particularly cumbersome, leaving many impacted communities unable to access needed resources.56

Towards solutions: Sector-based approaches, resilience and co-benefits

There are several promising pathways for circumventing some of these potential negative consequences of climate finance. Disaggregating state-level vulnerability assessments offers an apt starting point. There are proposals for a sector vulnerability index to serve as a criterion for the allocation of adaptation finance to developing countries. This index would seek to move beyond myopic country-level assessments of vulnerability, responsibility and capacity.57 Such an approach recognises that the impact distribution of climate change varies across sectors and that nationally aggregating vulnerability indicators risks affecting or even displacing equitable principles for allocating adaptation finance.58 Moreover, greater disaggregation might not prove to be a hugely difficult step to implement, as there is little evidence that state-level assessments strongly impact the funding streams for regional adaptation (nor has there been evidence that Annex 1 countries consider such assessments to be critical).

Regardless of the vulnerability measurement practices used, adaptation measures have to be proactive not reactive in character if they are to be successful. Resilience59 has become a byword in humanitarian, governance and environmental security spheres to this end. Compared to vulnerability and risk indices that have proliferated in the literature (including those spurred by consultancy firms), resilience metrics are in short supply. Of the existing resilience indices, one of the most comprehensive in terms of variables is the GAIN Index.60 The index measures both vulnerability to climate-related hazards (with 36 indicators) and readiness to adapt to challenges posed by climate change (with 14 indicators) and is targeted at the private sector. It illuminates sectors for investments that can build resilience and offers a practical tool for formulating national programmes to this end. The Climate and Disaster Resilience Index,61 on the other hand, has great potential but is limited in scope to urban zones and to climate‐related disasters (hydro‐meteorological disasters) such as cyclones, floods, heatwaves, droughts and landslides induced by heavy rainfall. However, despite their potential import, these resilience indicators are not currently situated to drive adaptation funding.

Questioning the ancillary effects of adaptation measures can also help to reduce many problems of maladaptive or ineffective financing and act as a guide for project prioritisation. Projects should make sense whether in terms of adaptation or development objectives, and adaptation should meet both the objectives of donor organisations and the needs and desires of target communities. Here, the so-called co-benefits of adaptation become particularly important. For example, the benefits of climate risk management activities (disaster planning, technological measures to improve infrastructure and the development of robust agricultural practices) could also promote sustainable development objectives and socioeconomic improvements. Investments in agriculture, in particular those that support the continued productivity of agricultural lands in the face of climate change, can improve yields while reducing land-use changes and thereby avoiding emissions.62 Employment generation, public health improvements, increased energy security and the like are all benefits that can stem from adaptation projects and are pragmatic regardless of climate-centric goals.

A recent study which looked at adaptation projects that have been approved or endorsed by the AF Board found that the projects generally ranked low in both cost-effectiveness and equity.63 Factors such as accessibility of resources, infrastructure, political support, kinship and informal institutions influence whether local or community-based adaptation will thrive (or not).64 Such problems could be reduced through working with local communities to foster co-benefits from adaptation projects that build resilience while contributing to development.

At present, co-benefits are oftentimes under-evaluated because of the difficulty in quantifying and assessing specific benefits to particular communities or localities.65 The Index of Usefulness of Practices for Adaptation (IUPA),66 a tool for evaluating adaptation projects and programmes during design, implementation and post-implementation phases, could provide an entry point for assessing co-benefits. The IUPA, or a similar tool, could potentially help unpack the effectiveness of climate finance if institutionalised in all adaptation programmes.

^ To the top

Conclusion

The challenges of climate adaptation finance mirror the broader problems long associated with aid and development support. Efforts to solicit assistance and compensation are understandable yet potentially problematic, as the previous discussion on vulnerability assessments, victimhood arguments and moral hazards shows. Lessons should be gleaned from wider aid experiences to promote judicious and effective adaptation strategies. To this end, it is advisable that co-benefits, resilience and emphases on specific contexts are kept at the centre of thinking on project development and funding. In other words, adaptation efforts that are positive for development, climate change notwithstanding, warrant priority.

For the Asia-Pacific, it is crucial to tap into existing networks of research organisations that focus on adaptation and resilience building. Networks such as the Asian Cities Climate Change Resilience Network, the Asia Pacific Adaptation Network, the Asian Co-benefits Partnership, and the Climate and Development Knowledge Network can provide independent external input for reliable, grassroots-based and empirical resilience assessments. Resilience assessments can serve as practical tools for allocating adaptation finance, and help reduce problems with vulnerability assessments and victimhood arguments that misrepresent the adaptive capacities of sectors, communities and countries. Additionally, these assessments can inform two practical activities for adaptation: (1) capacity building of local beneficiaries (from communities to sectors to local governments) to engage with the structures of climate finance; and (2) the tracking, monitoring and evaluation of the impact of climate finance from the donor down to the local level.

The possible pitfalls of climate adaptation financing in the Asia-Pacific show how challenging the whole project of adaptation has become. As communities, sectors and countries face growing climate risks and hazards, climate finance for adaptation will only become more critical. As such, the challenges of determining who gives what to whom, who needs it most and how it is used will largely define how resilience is accounted for in the future.

^ To the top

Notes

- Maplecroft’s Natural Hazards Risk Atlas 2012 and Climate Change Vulnerability Index 2013; Coastal City Flood Vulnerability Index, in S.F. Balica, N.G. Wright and F. van der Meulen, ‘A flood vulnerability index for coastal cities and its use in assessing climate change impacts’, Natural Hazards 64 (2012): 73–105, http://link.springer.com/content/pdf/10.1007%2Fs11069-012-0234-1.pdf; International Federation of Red Cross and Red Crescent Societies, World Disasters Report 2012 (2012), http://www.ifrc.org/publications-and-reports/world-disasters-report/

-

Based on the period 1970–2011. UN Development Programme (UNDP), Asia Pacific Human Development Report 2012 – One planet to share: Sustaining human progress in a changing climate (Bangkok: UNDP Asia-Pacific Regional Centre, 2012), http://www.undp.org/content/undp/en/home/librarypage/hdr/asia-pacific-human-development-report-2012/

-

UN Office for the Coordination of Humanitarian Affairs (OCHA), ‘Humanitarian snapshot: Natural disasters in the Asia-Pacific 2012’, infographic, accessed 22 February 2013, http://reliefweb.int/sites/reliefweb.int/files/resources/ROAP_Snapshot_disasters_2012.pdf

-

UNDP, Asia Pacific Human Development Report 2012.

-

Ibid.

-

See: R.V. Cruz et al., ‘Asia’, in Climate change 2007: Impacts, adaptation and vulnerability, Contribution of Working Group II to the Fourth Assessment Report of the Intergovernmental Panel on Climate Change, ed. M.L. Parry et al. (Cambridge, UK: Cambridge University Press, 2007), 469–506, http://www.ipcc.ch/pdf/assessment-report/ar4/wg2/ar4-wg2-chapter10.pdf; Lorraine Elliott (ed.), Climate change, migration, and human security in Southeast Asia (Monograph no. 24, Singapore: S. Rajaratnam School of International Studies (RSIS), 2012), http://www.rsis.edu.sg/publications/monographs/Monograph24.pdf; Susmita Dasgupta et al., ‘The impact of sea level rise on developing countries: A comparative analysis’, Climatic Change 93, nos 3–4 (2009): 379–88, http://dx.doi.org/10.1007/s10584-008-9499-5; Florian T. Wetzel et al., ‘Future climate change driven sea-level rise: Secondary consequences from human displacement for island biodiversity’, Global Change Biology 18, no. 9 (2012): 2707–19, http://dx.doi.org/10.1111/j.1365-2486.2012.02736.x

-

Cruz et al., ‘Asia’.

-

M.L. Parry et al., ‘Technical Summary’, in Climate change 2007, ed. Parry et al., 23–78, http://www.ipcc.ch/pdf/assessment-report/ar4/wg2/ar4-wg2-ts.pdf

-

Income inequality is worsening in 14 developing economies in the region. Asian Development Bank (ADB), Framework of inclusive growth indicators 2012: Key indicators for Asia and the Pacific, Special supplement, 2nd ed. (Mandaluyong City: ADB, 2012), http://www.adb.org/sites/default/files/pub/2012/ki2012-special-supplement.pdf

-

Cruz et al., ‘Asia’.

-

Of 305 large urban centres in the Asia-Pacific, 119 lie on coastlines that are frequently exposed to climatic hazards. See: UN Department of Economic and Social Affairs (UN DESA), World urbanization prospects: The 2011 revision – Highlights (New York, NY: UN, 2011), http://esa.un.org/unpd/wup/pdf/WUP2011_Highlights.pdf

-

For more on urban vulnerabilities and corresponding policies to address them, see ICLEI, ‘Climate change and vulnerability of people in cities of Asia’ (Asia Pacific Human Development Report Background Papers no. 6, Bangkok: UN Development Programme (UNDP) Asia-Pacific Regional Centre, 2012), http://www.snap-undp.org/elibrary/Publications/HDR-2012-APHDR-TBP-06.pdf

-

For example, in Nepal, there had been remarks on the rather ‘complex and lengthy procedure to access [Least Developed Countries] funds through [Implementing Agencies]’ that contribute to ‘further delays’ in project implementation. Cited in ‘Nepal: Bureaucracy holds up climate adaptation finance’, IRIN, 5 September 2012, http://www.irinnews.org/report/96242/NEPAL-Bureaucracy-holds-up-climate-adaptation-finance

-

Ibid. Again, the Nepal case is telling, and both funders and implementers in the country have been frustrated with the delays and uncertainties as a result of different criteria among funds.

- With direct access, countries can acquire funds through national entities rather than having to go through multilateral financial institutions that cater to other climate funds. See: Gianna Gayle Amul, ‘The Green Climate Fund: An opportunity to rationalise climate finance?’, NTS Alert, November (Singapore: RSIS Centre for Non-Traditional Security (NTS) Studies for NTS-Asia, 2012), http://www3.ntu.edu.sg/rsis/nts/html-newsletter/alert/nts-alert-nov-1201.html

-

Data from: ‘Regional trends: Asia and the Pacific’, Climate Funds Update, accessed 26 February 2013, http://www.climatefundsupdate.org/regions/asia-pacific

-

Climate Investment Funds (CIF), ‘Pilot Program on Climate Resilience (PPCR): Financing modalities’, 15 June 2010, https://www.climateinvestmentfunds.org/cif/sites/climateinvestmentfunds.org/files/PPCR_Financing_Modalities_final.pdf

-

See: Gareth Porter et al., ‘New finance for climate change and the environment’ (WWF and Heinrich Böll Stiftung Foundation, 2008), http://www.odi.org.uk/publications/2980-finance-climate-change-environment; Frances C. Moore, ‘Negotiating adaptation: Norm selection and hybridization in international climate negotiations’, Global Environmental Politics 12, no. 4 (2012): 30–48, http://dx.doi.org/10.1162/GLEP_a_00138

-

‘Least Developed Countries Fund (LDCF)’, Global Environment Facility, 2013, accessed 13 March 2013, http://www.thegef.org/gef/ldcf

-

Evaluation Department of the Ministry of Foreign Affairs of Denmark and the Global Environment Facility (GEF) Evaluation Office, Joint external evaluation: Operation of the Least Developed Countries Fund for adaptation to climate change (Ministry of Foreign Affairs of Denmark, 2009), http://www.thegef.org/gef/sites/thegef.org/files/documents/GEF.LDCF_.SCCF_.7.Inf4_.pdf

-

Richard J.T. Klein and Annett Möhner, ‘The political dimension of vulnerability: Implications for the Green Climate Fund’, IDS Bulletin 42, no. 3 (2011): 15–22, http://dx.doi.org/10.1111/j.1759-5436.2011.00218.x

-

The division into Annex 1 and non-Annex 1 dates back to the formation of the UNFCCC in the early 1990s and was based on economic development levels at that time. The degree to which this division remains appropriate for climate adaptation finance is addressed in a forthcoming section. For further background and lists of Annex 1 and non-Annex 1 countries, see: UN Framework Convention on Climate Change (UNFCCC), ‘Parties & observers’, accessed 12 May 2013, http://unfccc.int/parties_and_observers/items/2704.php

-

Data from: ‘Regional trends: Asia and the Pacific’, Climate Funds Update, sub-section titled ‘What is getting financed?’, accessed 17 September 2012, http://www.climatefundsupdate.org/regions/asia-pacific. It should be noted that these figures include resources geared towards REDD+ (Reducing Emissions from Deforestation and Forest Degradation) projects that lend economic value to the carbon stored in forests and offer incentives to developing countries to reduce emissions through protecting or adding to these carbon stocks. Importantly, this can also be viewed as an adaptation measure in cases where forests add to the resilience of communities. See: ‘About REDD’, UN-REDD Programme, accessed 13 March 2013, http://www.un-redd.org/AboutREDD/tabid/102614/Default.aspx

-

For an in-depth discussion, see: Stine Aakre and Dirk T.G. Rübbelke, ‘Objectives of public economic policy and the adaptation to climate change’, Journal of Environmental Planning and Management 53, no. 6 (2010): 767–91, http://dx.doi.org/10.1080/09640568.2010.488116

-

Harris and Symons further argue that the ambiguity of ‘statist arguments might support compensation payments between states for harms caused by recent emissions’. See: Paul G. Harris and Jonathan Symons, ‘Justice in adaptation to climate change: Cosmopolitan implications for international institutions’, Environmental Politics 19, no. 4 (2010): 617–36, http://dx.doi.org/10.1080/09644016.2010.48971610.1080/09644016.2010.489716

-

For more discussion on historical responsibility in international climate negotiations, see: Mathias Friman, ‘Historical responsibility: Assessing the past in international climate negotiations’ (Linkoping Studies in Arts and Science no. 569, Linkoping: Linkoping University, 2013), http://urn.kb.se/resolve?urn=urn:nbn:se:liu:diva-86920

-

J. Jackson Ewing, ‘From Kyoto to Durban: The fits and starts of global climate change negotiations’, NTS Insight, February (Singapore: RSIS Centre for Non-Traditional Security (NTS) Studies, 2012), http://www3.ntu.edu.sg/rsis/nts/HTML-Newsletter/Insight/NTS-Insight-Feb-1201.html; J. Jackson Ewing and Gianna Gayle Amul, ‘Is 2015 the new Copenhagen? How the UNFCCC process risks falling into faulty patterns’, NTS Bulletin, January (Singapore: RSIS Centre for Non-Traditional Security (NTS) Studies, 2013), http://www3.ntu.edu.sg/rsis/nts/html-newsletter/bulletin/nts-bulletin-jan-1301.html

-

David Ciplet, J. Timmons Roberts and Mizan Khan, ‘The politics of international climate adaptation funding: Justice and divisions in the greenhouse’, Global Environmental Politics 13, no. 1 (2013): 49–68.

-

For a discussion of the importance of both the physical and social contexts of climate impacts, see: J. Jackson Ewing, ‘Contextualising climate as a cause of migration in Southeast Asia’, in Climate change, migration and human security in Southeast Asia, ed. Elliott.

-

UN Framework Convention on Climate Change (UNFCCC), ‘Decision 3/CP.18 Approaches to address loss and damage associated with climate change impacts in developing countries that are particularly vulnerable to the adverse effects of climate change to enhance adaptive capacity’, Report of the Conference of the Parties on its eighteenth session, held in Doha from 26 November to 8 December 2012 (UNFCCC, 28 February 2013), http://unfccc.int/resource/docs/2012/cop18/eng/08a01.pdf

-

For a discussion on the different ‘debts’, see: ActionAid, ‘Loss and damage from climate change: The cost for poor people in developing countries’ (Discussion paper, Johannesburg: ActionAid, 2010), http://www.actionaid.org/sites/files/actionaid/loss_and_damage_-_discussion_paper_by_actionaid-_nov_2010.pdf

-

Ibid.

-

IRIN, ‘Insurance only part of disaster resilience, says climate change panel’, Guardian Development Network, 6 March 2013, http://www.guardian.co.uk/global-development/2013/mar/06/insurance-disaster-resilience-climate-change

-

Ibid.

-

For more on this argument, see: Dirk T.G. Rübbelke, ‘International support of climate change policies in developing countries: Strategic, moral and fairness aspects’, Ecological Economics 70, no. 8 (2011): 1472, http://dx.doi.org/10.1016/j.ecolecon.2011.03.007

-

Ewing, ‘From Kyoto to Durban’.

-

World Bank, ‘Economics of adaptation to climate change: Global cost estimate’, 2011, accessed 8 March 2013, http://climatechange.worldbank.org/content/adaptation-costs-global-estimate

-

See: Transparency International, Global Corruption Report: Climate change (London: Earthscan, 2011), http://www.transparency.org/whatwedo/publications/doc/gcr/

-

‘Corruption Perceptions Index 2012’, Transparency International, 2012, accessed 6 March 2013, http://cpi.transparency.org/cpi2012/results/

-

‘Overview’, GAIN Index, undated, accessed 28 February 2013, http://index.gain.org/about

-

See: Richard Behar, ‘World Bank spins out of control: Corruption, dysfunction await new president’, Forbes, 16 July 2012, http://www.forbes.com/forbes/2012/0716/feature-world-bank-robert-zoellick-too-big-to-fail.html;

Christopher M. Matthews, ‘Kim promises zero tolerance for corruption at World Bank’, The Wall Street Journal, 30 January 2013, http://blogs.wsj.com/corruption-currents/2013/01/30/kim-promises-zero-tolerance-for-corruption-at-world-bank/

-

For more, see: Lisa Anna Elges, ‘Identifying corruption risks in public climate finance governance’, in Handbook of global research and practice in corruption, ed. Adam Graycar and Russell G. Smith (Cheltenham: Edward Elgar Publishing, 2012),138.

-

Haigh further argues that ‘financial services remain on the periphery of policy implementation’ and that the discourses on ‘sustainability, individualism, material consumption, progress through financial instruments, opportunism and managerialism deflect attention away from the major emitters of greenhouse gases’. For more on the climate discourse in the policy and business arena, see: Matthew Haigh, ‘Climate policy and financial institutions’, Climate Policy 11, no. 6 (2011): 1367–85, http://dx.doi.org/10.1080/14693062.2011.579265

-

Elges, ‘Identifying corruption risks’, 147.

-

This definition of foreign aid is adapted from: Carol Lancaster, Foreign aid: Diplomacy, development, domestic politics (Chicago, IL: University of Chicago Press, 2007), 9.

-

For a discussion on mitigation-related ‘climate finance curse’, see: Michael Jakob et al., ‘Climate finance curse for developing country mitigation: Blessing or curse?’ (Working paper, Potsdam: Potsdam Institute for Climate Impact Research, 2012), http://www.pik-potsdam.de/members/jakob/publications/jakob-et-al-climate-finance-curse-or-blessing.pdf

-

See: Simeon Djankov, Jose G. Montalvo and Marta Reynal-Querol, ‘The curse of aid’, Journal of Economic Growth 13, no. 3 (2008): 169–94, http://dx.doi.org/10.1007/s10887-008-9032-8; Hristos Doucouliagos and Martin Paldam, ‘The aid effectiveness literature: The sad results of 40 years of research’, Journal of Economic Surveys 23, no. 3 (2009): 433–61, http://dx.doi.org/10.1111/j.1467-6419.2008.00568.x; Raghuram G. Rajan and Arvind Subramanian, ‘Aid and growth: What does the cross-country evidence really show?’ (Working Paper no. 11513, Cambridge, MA: National Bureau of Economic Research, 2005), http://www.nber.org/papers/w11513

-

Djankov et al. also argue that the need for checks and balances is usually neglected because most foreign aid is not contingent on the quality of democracy in beneficiary countries. For more on the effectiveness of aid and its impact on democracy, see the results of a study of 108 recipient countries covering the period 1960–1999 in: Djankov et al., ‘The curse of aid’.

-

Abdiweli M. Ali and Hodan Said Isse, ‘Determinants of economic corruption: A cross-country comparison’, Cato Journal 22, no. 3 (2003): 460, http://relooney.fatcow.com/CATO_03_23.pdf

-

See: Kevin M. Morrison, ‘What can we learn about the “resource curse” from foreign aid?’, The World Bank Research Observer 27, no. 1 (2010): 60, advance access 27 October 2010, http://dx.doi.org/10.1093/wbro/lkq013

-

Ibid., 59.

-

Marian Leonardo Lawson, Does foreign aid work? Efforts to evaluate U.S. foreign assistance (Report no. R42827, Congressional Research Service, 13 February 2013), 14, http://www.fas.org/sgp/crs/row/R42827.pdf

-

Djankov et al., ‘The curse of aid’; Doucouliagos and Paldam, ‘The aid effectiveness literature’; Rajan and Subramanian, ‘Aid and growth’.

-

In Indonesia for example, programmes are underway to reform a ‘bloated and underperforming’ bureaucracy to facilitate the implementation of its mitigation and adaptation programmes, particularly in reducing deforestation and forest degradation. See: Rhett A. Butler, ‘Bureaucratic reform plays a part in reducing deforestation in Indonesia’, mongabay.com, 17 January 2013, http://news.mongabay.com/2013/0117-interview-azwar-abubakar.html#

-

See study by: Paul Lehmann et al., ‘Understanding barriers and opportunities for adaptation planning in cities’ (UFZ Discussion Papers no. 19, Leipzig: Helmholtz-Zentrum für Umweltforschung GmbH - UFZ, 2012), http://www.ufz.de/export/data/global/45989_19%202012%20Lehmann%20et%20al_%20Urban%20Adaptation_internet_gesamt.pdf

-

For an example, see: Evaluation Department of the Ministry of Foreign Affairs of Denmark and GEF Evaluation Office, Joint external evaluation.

-

See for example: Hans-Martin Fussel, ‘How inequitable is the global distribution of responsibility, capability and vulnerability to climate change: A comprehensive indicator-based assessment’, Global Environmental Change 20, no. 4 (2010): 597, http://dx.doi.org/10.1016/j.gloenvcha.2010.07.009

-

Ibid., 608.

-

Resilience is defined as ‘the ability of a system and its component parts to anticipate, absorb, accommodate, or recover from the effects of a hazardous event in a timely and efficient manner, including through ensuring the preservation, restoration, or improvement of its essential basic structures and functions’. In: Intergovernmental Panel on Climate Change (IPCC), ‘Glossary of terms’, in Managing the risks of extreme events and disasters to advance climate change adaptation, A Special Report of Working Groups I and II of the IPCC (Cambridge: Cambridge University Press, 2012), 555–64, http://ipcc-wg2.gov/SREX/

-

‘Overview’, GAIN Index.

-

Kyoto University Graduate School of Global Environmental Studies, ‘Climate and Disaster Resilience Initiative: Reducing risks of extreme events and weather‐related disasters’ (Submission to the UN Framework Convention on Climate Change (UNFCCC), 2009), http://unfccc.int/files/adaptation/application/pdf/iedm_kyoto_uni_ap_update_drr_sep_09_2_sp.pdf

-

David B. Lobell, Uris Lantz C. Baldos and Thomas W. Hertel, ‘Climate adaptation as mitigation: The case of agricultural investments’, Environmental Research Letters 8, no. 1 (2013): 1–12, http://dx.doi.org/10.1088/1748-9326/8/1/015012

-

The study by Stadelmann et al. used the following indicators for ‘equity’: (1) vulnerability level; (2) poverty; and (3) equal funding per capita. The following indicators were used for ‘cost-effectiveness’: (1) economic savings in absolute terms; (2) economic savings in relative terms; and (3) human lives saved. See: Martin Stadelmann et al., ‘Equity and cost-effectiveness of multilateral adaptation finance: Are they friends or foes?’, International Environmental Agreements: Politics, Law and Economics, e-publication ahead of print (2013), http://dx.doi.org/10.1007/s10784-013-9206-5.

-

Bhim Adhikari and Krista Taylor, ‘Vulnerability and adaptation to climate change: A review of local actions and national policy response’, Climate and Development 4, no. 1 (2012): 61, http://dx.doi.org/10.1080/17565529.2012.664958

-

Eliska Bystricky et al., Co-benefits of private investment in climate change mitigation and adaptation in developing countries, Final Report (Ecofys, 2010), http://www.ecofys.com/files/files/2010ecofys_cobenefitsprivateinvestmitigationadaptationdevelopingcountries_website.pdf

-

Aside from being an assessment tool, the Index of Usefulness of Practices for Adaptation (IUPA) can assist both recipient and donor countries with the process of raising and allocating adaptation finance. For a discussion of the IUPA’s methodology, see: P. Debels et al., ‘IUPA: A tool for the evaluation of the general usefulness of practices for adaptation to climate change and variability’, Natural Hazards 50, no. 2 (2009): 211–33, http://dx.doi.org/10.1007/s11069-008-9333-4

^ To the top |