|

THE GREEN CLIMATE FUND: AN OPPORTUNITY TO RATIONALISE CLIMATE FINANCE?

By Gianna Gayle Amul

|

Is the new Green Climate Fund (GCF) set to be yet another unwieldy addition to the climate finance web? While the form of the GCF, and its functions, has yet to be fully determined, it has been framed in negotiations as an umbrella mechanism for all climate funds. This NTS Alert argues that, as an overarching instrument, its promise lies in the possibility that it could help rationalise the overly complex climate finance architecture, and in the process tackle the critical problems seen in current funding arrangements.

|

|

Climate finance is critical in funding climate change-related activities such as this mangrove planting effort in the Philippines, which aims to contribute to climate resiliency in low-lying areas.

Credit: Jessie F. de los Reyes.

|

|

Contents:

Recommended citation: Amul, Gianna Gayle, 2012, ‘The Green Climate Fund: An opportunity to rationalise climate finance?’, NTS Alert, November, Singapore: RSIS Centre for Non-Traditional Security (NTS) Studies for NTS-Asia.

| |

Introduction

‘Climate finance’ still does not have a universally agreed definition. Broadly, though, the term refers to the flow of financial resources from developed countries to fund incremental costs of climate change mitigation and adaptation in developing countries. This funding is part of commitments made under the UN Framework Convention on Climate Change (UNFCCC).

The latest development in climate finance is the Green Climate Fund (GCF). With the GCF set to be fully operational in 2014, now is the time to examine the direction it needs to take if it is to contribute to building an effective climate finance environment for supporting climate change adaptation as well as mitigation. To this end, this NTS Alert provides a brief outline of what the GCF is before going on to review the challenges that the GCF will have to tackle if it is to fulfil its objectives. The implications for Southeast Asia are also discussed.

^ To the top

The GCF: What’s new?

The GCF, agreed on at the 17th Conference of the Parties to the UNFCCC (COP17) in Durban, South Africa, in 2011, aims to help developing countries shift towards low-emissions power generation and improve their capacity to adapt to climate change. One of the main features of the GCF is a ‘direct access’ facility. With direct access, countries will be able to tap funds through national entities, rather than having to go through multilateral institutions. Another feature, touted as an ‘innovation’ of the GCF, is the much wider role envisioned for the private sector.

Designed to be a legally independent institution with its own secretariat and the World Bank as interim trustee, it is to function under the guidance of, and be accountable to, the COP (Schalatek et al., 2012:1). With many climate finance mechanisms due to end this year, the GCF has been framed in negotiations as an umbrella instrument for all climate funds (Barbut, 2011).

A whole gamut of proposals on its design has been seen since its establishment. Some focused on adaptation finance (Horstmann and Abeysinghe, 2011; Birdsall and de Nevers, 2012) and mitigation finance (Jakob et al., 2012). Others focused on governance (Abbott and Gartner, 2011; Barbut, 2011; Van Kerkhoff, 2011). Still others addressed the weaknesses of the Climate Investment Funds as lessons for designing the GCF (Fry, 2011) and explored the direct access facility of the GCF (Manuamorn and Dobias, 2012). The proposals largely tackled gaps and weaknesses in current climate finance arrangements, some of which are addressed next.

^ To the top

Climate finance today: Issues and gaps

With the GCF envisioned to be an overarching mechanism for all climate funds, there is a need to review the current climate finance architecture, and to assess the major issues and gaps and their implications for regions vulnerable to the impacts of climate change such as Southeast Asia.

A tangled web of funds

When looking at the climate finance architecture, its intricacy stands out. Table 1 provides some indication of the myriad of overlapping global and multilateral funds that combine with bilateral and national funds to make up the climate finance architecture. To add to the complexity, the climate finance web also includes public and private as well as market-based financing schemes. Countries wishing to access the funds would first need to understand the range of funds, what they are for and how to apply for them – which could turn out to be a complicated process.

|

Table 1: Major climate funds.

Funds |

Area of focus |

Amount (USD, billion) |

Administered by? |

Included as Official Development Assistance? |

Direct Access? |

GEF Trust Fund |

Mitigation Adaptation |

15.225 |

UNFCCC

GEF |

Yes |

No |

| Least Developed Countries Fund |

Adaptation |

0.18 |

Yes |

No |

| Special Climate Change Fund |

Adaptation |

0.12 |

Yes |

No |

| Adaptation Fund |

Adaptation |

0.165 |

Adaptation Fund Board |

No |

Yes, through CDM projects funded by CER credits |

Climate

Investment

Funds |

Mitigation Adaptation |

5 |

World Bank |

Yes |

No |

| UN-REDD |

Mitigation |

0.15 |

UNDP |

Yes |

No |

Abbreviations: CER – certified emission reduction; CDM – Clean Development Mechanism; GEF – Global Environment Facility; UNDP – UN Development Programme; UNFCCC – UN Framework Convention on Climate Change; UN-REDD – UN collaborative initiative on Reducing Emissions from Deforestation and Forest Degradation in developing countries.

Sources: www.climatefinanceoptions.org; www.climatefundsupdate.org; www.unfccc.int; www.adaptation-fund.org;

www.climateinvestmentfunds.org; www.un-redd.org; www.thegef.org |

The mitigation bias

Major multilateral funds such as the Global Environment Facility and the Climate Investment Funds have multiple foci (Table 1). In practice, however, a majority of the projects funded under these schemes are mitigation-focused.

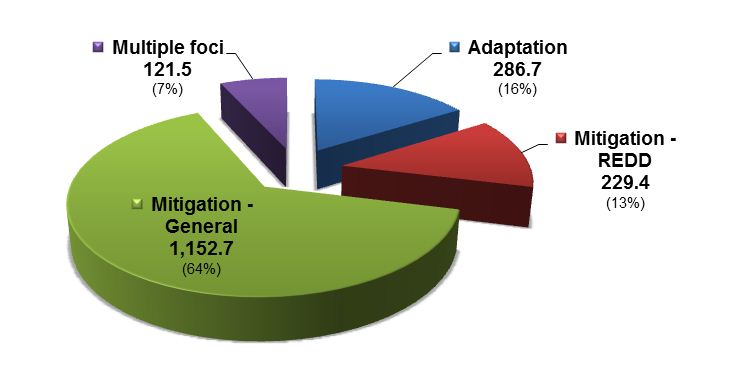

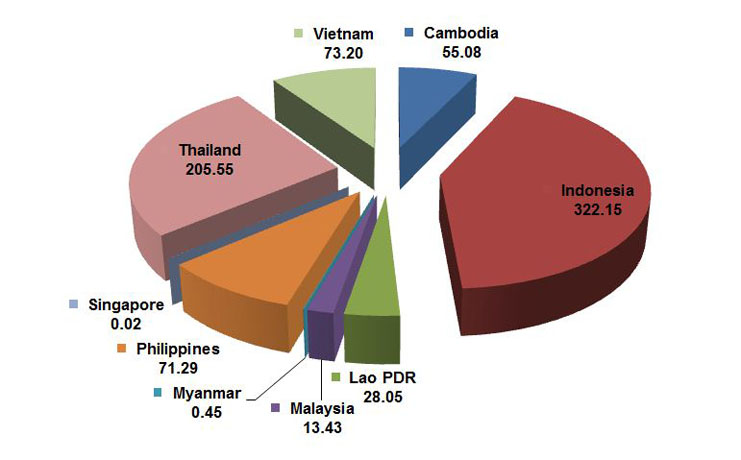

The picture remains the same when the Asia-Pacific is examined (Figure 1). Over three-fourths of the funds disbursed in the region from 2004 to 2012 were given to mitigation projects. Only 16 per cent went to adaptation efforts; and just 7 per cent to multiple foci projects. The bias towards mitigation is also seen in Southeast Asia. From 2004 to 2012, ASEAN countries (excluding Brunei) received an estimated USD769 million from climate funds. Indonesia alone received over 42 per cent of that. Tellingly, most of the funds received by Indonesia can be attributed to mitigation projects under the UN collaborative initiative on Reducing Emissions from Deforestation and Forest Degradation in developing countries (UN-REDD) (Climate Funds Update, 2012a).

With little financing for adaptation, the mountain of adaptation-focused Clean Development Mechanism (CDM) projects in China, India and Brazil and smaller ones in Vietnam, Malaysia, Indonesia, Thailand, the Philippines and Singapore are all rummaging for funds (Adaptation Fund, 2011a).

|

Figure 1: Disbursement of climate funds in the Asia-Pacific, 2004–2012 (USD, million).

Abbreviation: REDD – Reducing Emissions from Deforestation and Forest Degradation.

Source: Climate Funds Update (2012a).

|

|

Figure 2: Disbursement of climate finance to ASEAN countries except Brunei, 2004–2012 (USD, million).

Source: Dataset from Climate Funds Update (2012b). |

Reliance on funding from developed countries

ASEAN’s adaptation and mitigation efforts are heavily reliant on developed countries for ‘adequate, predictable and sustainable financial resources’ (ASEAN, 2009). Some ASEAN member states – Indonesia, Thailand and the Philippines for instance – have set up their own national climate change funds. However, these funds are financed through bilateral and multilateral instruments. For example, bilateral development institutions such as Japan’s Fast Start Finance and Australia’s International Forest Carbon Initiative fund national REDD+ projects in Southeast Asia. The Indonesia Climate Change Trust Fund has received USD19 million in pledges from the UK, Australia and Sweden in addition to a majority of the UN-REDD grants funded by Norway (Nakhooda et al., 2011b:3). These underscore how dependent ASEAN countries are on external funding, and thus on the commitment of developed countries to providing such funds.

Given the complexities of the climate finance architecture and the external partnerships described above, the complementarity of the GCF with existing climate finance mechanisms has understandably attracted scepticism. Some observers and practitioners have argued that the GCF could yet be another ‘anaemic’ fund destined to be a ‘beautifully articulated but largely empty shell’ (Barbut, 2011; Fry, 2011; Schalatek et al., 2012). How can the GCF avoid that fate? To begin to even answer this, there is a need to look at the varied challenges facing the GCF.

^ To the top

The challenges facing the GCF

With ambitions of making the GCF the umbrella mechanism for all climate funds in play, the GCF needs to be able to address the limitations seen in the current climate finance architecture as well as firm up issues related to its own implementation. The points outlined below provide some indication of the scale of the task facing the GCF.

Tackling existing climate finance issues

- New and additional funding

It is vital that climate finance is ‘new and additional’ to existing development aid. However, with a majority of the climate funds coming under development assistance (see Table 1), determining what is new and additional becomes more convoluted. The problem, as is the case with many terms related to climate finance instruments, is that countries tend to differ in the baselines they use to determine which funds are new and additional (see Brown et al., 2010). The baseline should ideally be the ‘finance volume that would have flowed to developing countries in the absence of climate finance flows’ (Stadelmann et al., 2011:176). The GCF has the opportunity to standardise the baseline for overall climate finance and thus allow for more accurate assessments of the novelty and additionality of post-2012 climate funds.

- Debates over responsibility

The funding under the GCF could lead developing states to become even more dependent on climate funds to bankroll their mitigation and adaptation projects. Such dependency is risky given the vacillations seen on climate finance pledges. Despite the 2009 pledge at the COP15 in Copenhagen to mobilise USD100 billion per year in long-term financing by 2020, consensus on long-term finance failed to be fully realised in Durban. The European Union has shown willingness to commit funds. The US, however, has seemed unwilling to share the burden with the European Union. In a report for the US Congress, Lattanzio (2011:12) argued that the US pledges for fast start financing and UNFCCC 2020 targets as well as its bilateral aid are not tied to the GCF.

According to US special envoy for climate change Todd Stern (2012), the US believes that the climate process is ‘dubiously’ founded on an ‘illegitimate’ paradigm of a ‘firewall’ between developed and developing countries. It contests the notion that developed countries should bear the brunt of the financial costs of tackling climate change impacts in developing countries. The GCF would thus need to work on balancing the responsibility of developed countries with those that are still developing – not only on climate finance but also on green-growth strategies.

- Mitigation and adaptation priorities

As highlighted earlier, climate finance is currently heavily weighted towards mitigation. However, adaptation efforts are just as important, particularly to developing countries faced with serious climate vulnerabilities. Supporting adaptation projects may seem to have direct impacts only at local and regional levels but it can indirectly benefit both developed and developing countries in terms of building the confidence and trust so critical to any progress in international negotiations (Rubbelke, 2011:1470, 1478).

The GCF could play a role in ensuring a better balance between adaptation and mitigation projects, and bolster efforts to build more climate-resilient communities. However, it remains to be seen whether priority will be given to this issue. Increasingly, though, ASEAN, as an observer in the UNFCCC process, has urged developed countries to provide new and additional funding that takes into account the vulnerability of the least developed countries and those highly affected by climate change (ASEAN, 2010).

- Transparency and accountability

Observers have pointed out the lack of transparency and accountability in most climate financing schemes, which is worsened by difficulties in establishing coherent, consistent and universal mechanisms for monitoring, verifying and reporting, especially in bilateral initiatives (Elges, 2011; Nakhooda et al., 2011a; Transparency International, 2011; Jakob et al., 2012). Given this context, the GCF could be seen more as a further complication to the already complex web of climate finance.

Strengthening the GCF’s design

- Ambiguity in the GCF draft governing instrument

Developing and developed countries were poles apart in their vision for the GCF. Developing countries wanted not only simplified direct access to new and additional funds but also predictable and adequate contributions from developed countries (Schalatek et al., 2012). On the other hand, developed countries wanted to reduce the public sector component of climate finance, as well as weaken the GCF’s ties to the UNFCCC in order to utilise private investments more (Schalatek et al., 2012). This was reflected in the ambiguous character of the draft governing instrument that was surprisingly approved in Durban in 2011 (Schalatek, 2012; Schalatek et al., 2012). Such ambiguity could of course be a source of flexibility, but of concern is that it could lead to complacency about concrete operational definitions and baselines, in short, the specifics of the GCF.

Under the GCF, the private sector is expected by developed countries to have a ‘transformational’ funding role (Ewing and Gopalakrishnan, 2012). The private sector can bring in expertise in innovative financing instruments (Gray and Tatrallyay, 2012). However, reliance on private sector investment raises questions of whether private sector activities would necessarily be consistent with the national climate finance objectives of developing countries (Schalatek et al., 2012:3). Furthermore, while private sector funds tend to be larger than public sector funds, they also tend to be more ‘difficult to measure, track and allocate’ (Chaum et al., 2011; Nakhooda et al., 2011a). With the private sector envisaged to play a larger role under the GCF, there is a definite need to address such difficulties.

- Accreditation and enabling direct access

The GCF is expected to have a direct access mechanism managed by national implementing entities (NIEs), based on the rationale of climate finance being ‘country-driven, equitable and sustainable’ (UNFCCC, 2012). However, in order to be accredited, these institutions would need to have the capacity to manage the funding based on international systems and standards (Manuamorn and Dobias, 2012:8). The experience of accrediting NIEs to manage the Adaptation Fund’s direct access facility suggests that the GCF is likely to find the accreditation process as challenging as ensuring the accessibility of the fund (Manuamorn and Dobias, 2012:8). A case in point is the current lack of an accredited NIE from any of the ASEAN member countries. Instead, the Asian Development Bank (ADB) is accredited by the Adaptation Fund as a multilateral implementing entity (Adaptation Fund, 2011b).

- Lack of trust in the World Bank

Critics also question the credibility of the GCF given that the World Bank is its interim trustee. There is general distrust of the World Bank in many circles. The Bank is viewed as ‘non-transparent, overly bureaucratic and reflecting solely the interest of high-income countries’ with potential ‘conflict of interest’ resulting from its management of the Climate Investment Funds (Lattanzio, 2011:7). Adding voice to the general disapproval is the Bretton Woods Project (2012), which highlighted the World Bank’s ‘complicity in the climate crisis’ through its investments in the Asia-Pacific which produce or heavily use fossil fuels.

The challenges outlined above clearly shows that the GCF faces a hard task ahead of 2014. If the GCF is to be effective, it needs to be able to balance the goals and needs of the various stakeholders. How the GCF can do this is explored next.

^ To the top

Conclusion: Balancing priorities and needs

Joint responsibility is a demanding issue that the GCF must pay attention to in order to move forward on the climate process. Taking concrete steps to mitigate climate change while concurrently building climate resilience requires the commitment of both developed and developing countries. To facilitate buy-in from all stakeholders, the GCF would have to accommodate the need to align the climate policies that are set in international climate negotiations with the national and community development priorities of developing countries. It should also ensure accountability through promoting local ownership of projects, leveraging on local support, participation and priority setting rather than merely focusing on donor priorities.

The GCF is in a position to lead in rationalising the existing climate finance architecture. Streamlining processes in climate finance, whether through market-based financing mechanisms or through direct access facilities, can lead to a shift from the usual project-based funding to programmatic long-term climate finance. However, to be effective, the GCF must ensure complementarity with existing climate finance instruments, and also that there is a balance between mitigation and adaptation in the allocation of funds.

An outstanding issue is that the GCF does not specify what types of projects it aims to fund. At the 2012 UN Conference on Sustainable Development (Rio+20), it was suggested that the GCF could subsidise the transformation of energy production towards low-carbon development within the framework of green growth (UNCSD, 2012). It is worth noting that the GCF’s governing instrument does state that it will help the UNFCCC achieve its ‘ultimate objective’ (UNFCCC, 2012), a (vague) reference to the goal set by the UNFCCC in 1992, namely, ‘stabilization of greenhouse gas concentrations … to prevent dangerous anthropogenic interference with the climate system’, so green-growth projects do appear to fall within the GCF’s purview. If the GCF funds such projects, a more viable route would be to invest in – and not just subsidise – innovations that advance climate-friendly development.

In Southeast Asia, it remains to be seen how the Philippines and Indonesia, as representatives from the Asia-Pacific on the GCF Board, will balance regional and national interests (Schalatek, 2012). The rest of ASEAN’s increasingly vulnerable members require that they strongly put forward the case for leadership and regional cooperation on climate policy.

ASEAN itself must assume a more relevant role in the UNFCCC and push for an integrated climate-resilient region. The regional grouping could provide purposeful inputs into UNFCCC processes so as to pave the way for a synthesis between the ASEAN Community framework and the UNFCCC. This will enable ASEAN to embed the GCF into the regional framework and ensure that the region can proficiently utilise the GCF to address climate change. By effectively using existing cooperative frameworks, climate finance becomes not only a shared responsibility but also a solution to the impacts of climate change.

To sum up, given all the challenges associated with current climate finance instruments, the GCF has to go beyond enabling the climate process to move beyond 2012 commitments. It has to boldly tackle the critical issues and gaps identified in this NTS Alert. Only by being different and innovative can it ensure that it does not become just another climate fund.

^ To the top

References

Abbott, Kenneth W. and David Gartner, 2011, ‘The Green Climate Fund and the future of environmental governance’, Earth System Governance Working Paper No. 16, Lund and Amsterdam: Earth System Governance Project. http://www.earthsystemgovernance.org/sites/default/files/publications/files/ESG-WorkingPaper-16_Abbott%20and%20Gartner.pdf

Adaptation Fund,

2011a, ‘Funded projects’. http://www.adaptation-fund.org/funded_projects

2011b, ‘Multilateral implementing entities’. http://www.adaptation-fund.org/multilateral-implementing-entities

ASEAN,

2009, ASEAN Joint Statement on Climate Change to the 15th session of the Conference of the Parties to the United Nations Framework Convention on Climate Change and the 5th session of the Conference of Parties serving as the Meeting of Parties to the Kyoto Protocol, Cha-am Hua Hin, Thailand, 24 October. http://www.aseansec.org/23578.htm

2010, ASEAN Leaders’ Statement on joint response to climate change, Hanoi, 9 April. http://www.aseansec.org/24515.htm

Barbut, Monique, 2011, ‘Climate finance: Putting the puzzle together’, UN Chronicle, No. 4. http://www.un.org/wcm/content/site/chronicle/home/archive/issues2011/7billionpeople1unitednations/climatefinanceputtingthepuzzletogether

Birdsall, Nancy and Michele de Nevers, 2012, ‘Adaptation finance: How to get out from between a rock and a hard place’, Center for Global Development Policy Paper No. 1, Washington, DC: Center for Global Development. http://www.cgdev.org/content/publications/detail/1425965

Bretton Woods Project, 2012, ‘World Bank’s climate record in the dark’, Update No. 82, 2 October. http://brettonwoodsproject.org/art-571181

Brown, Jessica, Neil Bird and Liane Schalatek, 2010, Climate finance additionality: Emerging definitions and their implications, Climate Finance Policy Brief No. 2, London and Washington, DC: Overseas Development Institute and Heinrich Boll Stiftung North America. http://www.odi.org.uk/resources/docs/6032.pdf

Chaum, Miriam, Chris Faris, Gernot Wagner et al., 2011, Improving the effectiveness of climate finance: Key lessons, Climate Policy Initiative. http://climatepolicyinitiative.org/wp-content/uploads/2011/12/Improving-Effectiveness-of-Climate-Finance.pdf

Climate Funds Update,

2012a, ‘Asia and the Pacific: What is getting financed?’, 17 September. http://www.climatefundsupdate.org/regions/asia-pacific

2012b, Dataset from ‘Asia and the Pacific: Who’s receiving the money?’, 17 September. http://www.climatefundsupdate.org/regions/asia-pacific

Elges, Lisa Ann, 2011, ‘Identifying corruption risks in public climate finance governance’, in Adam Graycar and Russell G. Smith (eds), Handbook of global research and practice in corruption, Cheltenham: Edward Elgar Publishing.

Ewing, J. Jackson and Tarun Gopalakrishnan, 2012, ‘Rio+20 Incorporated? Assessing diplomatic outcomes and private sector actions on sustainable development’, NTS Insight, August, Singapore: RSIS Centre for Non-Traditional Security (NTS) Studies. http://www3.ntu.edu.sg/rsis/nts/HTML-Newsletter/Insight/NTS-Insight-aug-1201.html

Fry, Tom, 2011, A faulty model: What the Green Climate Fund can learn from the Climate Investment Funds, London: Bretton Woods Project. http://www.brettonwoodsproject.org/doc/env/afaultymodel.pdf

Gray, Steven and Nicholas Tatrallyay, 2012, The Green Climate Fund and private finance: Instruments to mobilise investment in climate change mitigation projects, London: Climate Change Capital. http://www.climatechangecapital.com/media/279342/thinktank%20green%20climate%20fund.pdf

Harvey, Fiona, 2012, ‘Green Climate Fund to discuss $100bn pledged by rich countries’, Guardian, 23 August. http://www.guardian.co.uk/environment/2012/aug/23/un-green-climate-fund-climate-change

Horstmann, Britta and Achala Chandani Abeysinghe, 2011, ‘The Adaptation Fund of the Kyoto Protocol: A model for financing adaptation to climate change?’, Climate Law, Vol. 2, No. 3, pp. 415–37. http://dx.doi.org/10.3233/CL-2011-043

Jakob, Michael, Jan Christoph Steckel, Christian Flachsland et al., 2012, ‘Climate finance for developing country mitigation: Blessing or curse?’, Potsdam Institute for Climate Impact Research Working Paper, Potsdam. http://www.pik-potsdam.de/members/steckel/publications/climate-finace-curse-or-blessing

Lattanzio, Richard K., 2011, International climate change financing: The Green Climate Fund (GCF), CRS Report for Congress No. R41899, Congressional Research Service (CRS). http://fpc.state.gov/documents/organization/167969.pdf

Manuamorn, Ornsaran Pomme and Robert Dobias, 2012, Understanding the Green Climate Fund: Implications for the evolving architecture of direct access to climate finance, ADAPT Asia-Pacific Discussion Paper, AECOM International Development. http://www.adapt-asia.org/library/understanding-green-climate-fund-implications-evolving-architecture-direct-access-climate

Nakhooda, Smita et al.,

2011a, The evolving climate finance architecture, Climate Finance Fundamentals Brief No. 2, London and Washington, DC: Overseas Development Institute and Heinrich Boll Stiftung North America. http://www.odi.org.uk/resources/docs/7468.pdf

2011b, Regional briefing: Asia and the Pacific, Climate Finance Fundamentals Brief No. 8, London and Washington, DC: Overseas Development Institute and Heinrich Boll Stiftung North America. http://www.odi.org.uk/resources/docs/7475.pdf

Rubbelke, Dirk T.G., 2011, ‘International support of climate change policies in developing countries: Strategic, moral and fairness aspects’, Ecological Economics, Vol. 70, No. 8, pp. 1470–80. http://dx.doi.org/10.1016/j.ecolecon.2011.03.007

Schalatek, Liane, 2012, ‘Taking charge: At its first meeting, the GCF Board lays the groundwork for the functioning of the new fund’, Washington, DC: Heinrich Boll Stiftung. http://www.boell.org/downloads/Schalatek_Taking_Charge.pdf

Schalatek, Liane, Smita Nakhooda and Neil Bird, 2012, The Green Climate Fund, Climate Finance Fundamentals Brief No. 11, London and Washington, DC: Overseas Development Institute and Heinrich Boll Stiftung North America. http://www.odi.org.uk/resources/docs/7595.pdf

Stadelmann, Martin, J. Timmons Roberts and Axel Michaelowa, 2011, ‘New and additional to what? Assessing options for baselines to assess climate finance pledges’, Climate and Development, Vol. 3, No. 3, pp. 175–92. http://dx.doi.org/10.1080/17565529.2011.599550

Stern, Todd, 2012, ‘Remarks at Dartmouth College, Hanover, NH, 2 August’, US Department of State. http://www.state.gov/e/oes/rls/remarks/2012/196004.htm

Transparency International, 2011, Global corruption report: Climate change, London and Washington, DC: Earthscan. http://www.transparency.org/whatwedo/pub/global_corruption_report_climate_change

UN Conference on Sustainable Development (UNCSD), 2012, ‘The Green Climate Fund: Financing for green growth’, Meeting, 19 June. http://www.uncsd2012.org/index.php?page=view&nr=1043&type=13&menu=23

UN Framework Convention on Climate Change (UNFCCC),

1992, United Nations Framework Convention on Climate Change, New York, NY: UN, 9 May. http://unfccc.int/resource/docs/convkp/conveng.pdf

2012, ‘Governing instrument for the Green Climate Fund’, in Report of the Conference of the Parties on its seventeenth session, held in Durban from 28 November to 11 December 2011, FCCC/CP/2011/9/Add.1, Annex to decision 3/CP.17. http://unfccc.int/resource/docs/2011/cop17/eng/09a01.pdf

Van Kerkhoff, Lorrae, Imran Habib Ahmad, Jamie Pittock et al., 2011, ‘Designing the Green Climate Fund: How to spend $100 billion sensibly’, Environment, Vol. 53, No. 3. http://www.environmentmagazine.org/Archives/Back%20Issues/2011/May-June%202011/green-climate-fund-full.html

^ To the top |