Page 48 - Nanyang Technological University

P. 48

NOTES TO FINANCIAL STATEMENTS

(cont’d)

31 March 2016

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont’d)

2.6 Property, plant and equipment (cont’d)

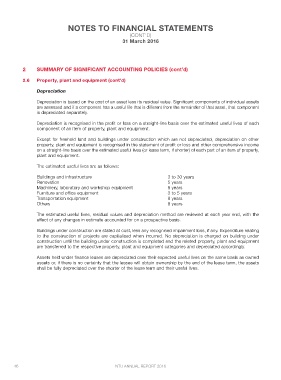

Depreciation

Depreciation is based on the cost of an asset less its residual value. Significant components of individual assets

are assessed and if a component has a useful life that is different from the remainder of that asset, that component

is depreciated separately.

Depreciation is recognised in the profit or loss on a straight-line basis over the estimated useful lives of each

component of an item of property, plant and equipment.

Except for freehold land and buildings under construction which are not depreciated, depreciation on other

property, plant and equipment is recognised in the statement of profit or loss and other comprehensive income

on a straight-line basis over the estimated useful lives (or lease term, if shorter) of each part of an item of property,

plant and equipment.

The estimated useful lives are as follows:

Buildings and infrastructure 3 to 30 years

Renovation 5 years

Machinery, laboratory and workshop equipment 6 years

Furniture and office equipment 3 to 5 years

Transportation equipment 8 years

Others 8 years

The estimated useful lives, residual values and depreciation method are reviewed at each year end, with the

effect of any changes in estimate accounted for on a prospective basis.

Buildings under construction are stated at cost, less any recognised impairment loss, if any. Expenditure relating

to the construction of projects are capitalised when incurred. No depreciation is charged on building under

construction until the building under construction is completed and the related property, plant and equipment

are transferred to the respective property, plant and equipment categories and depreciated accordingly.

Assets held under finance leases are depreciated over their expected useful lives on the same basis as owned

assets or, if there is no certainty that the lessee will obtain ownership by the end of the lease term, the assets

shall be fully depreciated over the shorter of the lease term and their useful lives.

46 NTU ANNUAL REPORT 2016